Know Everything About Profession Tax in Karnataka

If you have ever noticed your pay slip each month you would have seen a minor deduction along with the likes of HRA (housing rent allowance), the basic salary related breakups, and conveyance, to name a few. This deduction is normally in the region of INR 200 and is referred to as professional tax.

As far as India is concerned, this tax rate happens to be different for each state. In fact, in certain states you may also see that there is no deduction being made under this particular heading.

What is professional tax and who levies it?

Professional tax can be described as a tax that is charged by the state government. It is normally imposed on all people who are earning a living some way or the other in the state. In this case the term professional should not be confused with the definition of professionals that would include people such as doctors.

This is basically a tax that you have to pay if you are an individual who earns and meets the particular limit. This figure normally differs between states.

However, it does not get above INR 2500 on a yearly basis no matter which state you may be in.

It also needs to be stated in this context that this rate is different for different individuals as well.

Who is liable to pay professional tax in Bangalore?

In Karnataka Tax on Profession, Trades, & Calling, both salaried as well as self-employed earners and the business entities have to pay this tax to the state government of Karnataka. As far as salaried people are concerned it is the responsibility of the employers to collect the tax.

The following categories are required to pay professional tax in Karnataka:

- Companies

- Corporations

- Other corporate bodies

- Firms

- Hindu undivided family (HUF)

- Any club or association

- Any society

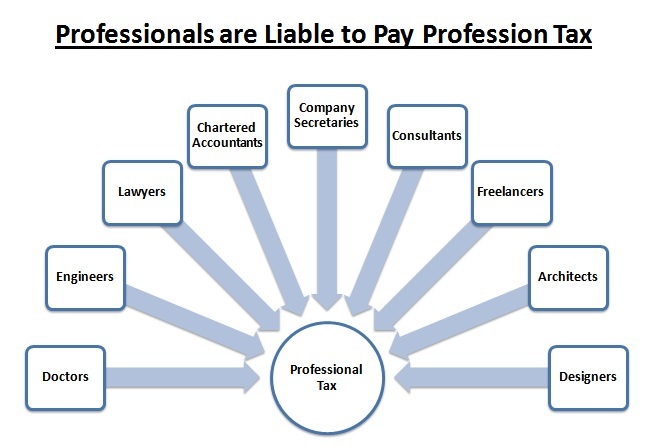

With regards to the self employed people they need to pay it to the people who have been appointed by the state government for such purposes. Professionals such as doctors, chartered accountants, and lawyers have to pay this particular tax over here in Karnataka.

See, these professionals are required to pay the profession tax:

Professional tax rate in Karnataka

In Karnataka professional taxes are levied as per the Karnataka Tax on Professions, Trades, Callings and Employment Act 1976.

As far as salary and wage earners in the state are concerned professional tax does not apply if you earn less than INR 15000 a month.

If you are earning more than INR 15000 a month for the year 2019-20; you would need to pay INR 200 for each month.

However, it also needs to be stated in this particular context that there are other categories of professional tax payers in the state as well and the rates for them are different.

Professional tax slab rate in Karnataka for salaried person

| Salary/Wage Range | For Employee | Tax Amount |

| Less than Rs. 15,000/- Per Month | 1 Employee | Nil |

| Not less than and above Rs. 15,000/- Per Month | 1 Employee | Rs. 200 |

Who are exempted from paying professional tax in Karnataka?

There are certain classes that do not need to pay professional tax in the state. These are –

- All the philanthropic and charitable hospitals and nursing homes that are located at places that are lower than the taluk level in each and every district of the state would not need to pay this tax. This however does not include Bangalore and the Bangalore Rural District.

- Directors of companies that are registered in the state and have been nominated by financing agencies that are controlled or owned by the state government, or any other statutory body, are exempt from this tax.

- Technicians from other countries working in the state under appointment from the national government are exempted from paying this tax as well. However, this exemption would be applicable only for a period of 2 years from the date when the concerned professional joined his work.

- The employee who has attained 65 years of age, tax is not deducted from him/her.

- The employee who has employed but not worked more than 120 days in respective year, tax shall not be deducted from him.

- Physically handicapped and blind persons are exempted from Karnataka professional tax.

- The persons running educational institutions and teaching classes up to 12th standard or pre-University are exempted.

Documents required for professional tax registration in Karnataka

Following are the documents needed for registering for professional tax in Karnataka:

- Copy of PAN (permanent account number) Card for applicants – in case it is a company it is the directors’ PAN cards that would be needed

- AOA (articles of association) and MOA (memorandum of association) if it is a company

- Copy of ID (identification) proof of applicants and director in case it is a company –it is preferable to provide the Aadhaar Card in these cases

- Declaration, if it is a company

- Passport size photo of applicant or director in case it is a company

- Sale deed if the property is owned

- Mobile number and email ID of applicants and directors if it is a company

- Rent agreement if the property has been rented

- Residence proof of registered office – it is better to provide copies of mobile bill, telephone bill, electricity bill, or gas bill

- PT authorization letter

You need to provide scanned copies of these documents when you make the application.

How to enroll for professional tax (PT) registration?

We want to clear you one thing regarding on enrollment and registration. Because these two things are little bit different; so who shall have to acquire PT enrollment certificate and who needs this registration?

So, you have to understand and aware about the simple difference on them.

Case of Enrollment

As it is stated in Karnataka Act 35 of 1976; In Schedule for Class of persons from Sl. No. 2 to 74 shall have to obtain a Certificate of Enrollment from the Profession Tax Officer of the jurisdiction.

The companies or businesses owners have the responsibilities to enroll for PT (professional tax) for doing business in Karnataka State and shall have to pay certain annual tax before 30th April of every year.

Case of Registration

The employees of Sole Proprietorship/ Partnership/ LLP/ OPC/ Pvt Ltd/ Public companies or any other business organization are getting salary above and not less than Rs. 15,000 monthly have to pay tax on profession.

And it is the responsible of employer to deduct the tax from employees account and pay to State Government and it can be done through filing of monthly PT return. For this, the organization has to obtain PT registration from department.

Therefore, a company having employees has to do both registration and enrollment.

If you wish to be registered for professional taxes in Karnataka; you can get help and support from us. We’ll help you complete your PT application process & obtain enrollment and registration certificate for your business.

PT registration process

You need to visit the official personal tax website. The process is rather simple. By visiting the website you can apply online for registration. Go to https://pt.kar.nic.in/ link for personal tax enrollment and then click on the same. After that you would need to follow the instructions as they appear on the website.

4 simple steps to get PT enrollment & registration certificate:

- Prepared documentation for PT registration

- Visit to e-PRERANA website

- For Enrollment Certificate (EC), click on “Enrollment Application” from left panel of e-Services and fill the details. Then make payment online, then take a print of enrollment application and after that you will get enrollment certificate.

- For New Registration Certificate (RC), click on “New RC Request”, fill the entire mandatory field, Sent OTP to Mobile and Verify the number, then you will receive a Acknowledgement No; Through this you can get a RC certificate.

How long does it take to register professional tax?

It takes at least 5 days of working time in Karnataka to get PT enrollment and registration number.

We can apply it in 1 day; however to get the User ID and Password, we’ve to visit the PT office and submit the application with all documents in physical data format, and then the concerned PT officer will verify it. After verification, they issue a User ID & Password for your organization and we receive it. Then we can proceed for PT filing.

Note: The important thing is that the person who is going to collect the login details from PT office has to take an authorization letter from organization head with seal and signature. So that he/she can be treated as the concerned person for receiving details.

Due date for payment of professional tax in Karnataka

As per Karnataka profession tax, every employer or other taxable person has to make the payment of professional tax on or before 20th of every subsequent month.

And 30th May of every year is the last date for filing of annual statements and it is to be filed with Form-5A.

Professional tax registration fees

Consultants or tax professionals charge fees for doing your PT registration and filing returns on time and it varies from one consultancy to other. So before going with them, ask how much they are charging, what services they’ll offer, for how many employees they’ll do filing or anything it is coming to your mind can ask and judge them with their work capability, service and its output.

Penalties for not paying the professional tax

If as an employer you do not register for professional tax in Karnataka you would be charged a fine of INR 1000. In case, you are not a business owner this fine would come down to INR 500.

If as an employer you do not file returns for your employees you would have to pay a fine of INR 250.

If you have registered for the tax and are not paying it then a fine of 1.25 per cent of the outstanding amount would be levied at you on a monthly basis. However, this can go up to a maximum of 50 per cent of the outstanding amount.

How to file PT return online in Karnataka?

Nowadays, the state government of Karnataka has come up with a website named e-Prerana (web link – https://pt.kar.nic.in/(S(pvyjes1a4nocykl51dyfdnae))/Main.aspx). Here professional tax payers can come and enter their returns, and then submit it online as well. This website also enables them to make the payments online.

If they wish they can also generate professional tax certificates online and the best part of this is that they do not also need to go to the professional tax office for the purpose.

How much PT registration fee?

Thank you for asking us. We normally charge Rs. 5000 for professional tax service, but it depends upon your number of employees and returns. Based on your no. of employees a charge can be determine.

Please, could you tell us how many employees are working in your organization!

Contact us for more details, You’ll get a clear-cut idea about PT return on deduction.

Thank you for having this nice website to understand the PT and compliances in Karnataka. Recently we started a pVT LTD company in karantaka. For the last year we have paid 2500. Every motnh we are filing our PT return for all the employees. I want to know few things….

1. For the annual return (PT), do we need to go to enrollment application again and then update the details and then pay 2500 rupees. We already have our EC #?

2. As we file our monthly PT, do we also need to file annual PT using website where we file monthly return? Below that there is another column mentioning annual return, where we eneter the information how much taxes we paid every month…

For your 1st query, you’ve to do same by choosing the Category of Enrollment option as “Enrolled”.

And another option is there. You can pay PT annual payment through GST number (by visiting this link https://vat.kar.nic.in/epay/) and download Enrollment Certificate from ePrerana home page while scrolling down a little where it is mentioned “Click here to download Enrollment Certificate”.

For your 2nd query, you can do same what you’ve mentioned in second.

I have recently started a OPC company in Karnataka consisting of only one directors. I do not have any employees. I have a directors with DIN number. Do we need to pay directors professional tax? I am not salaried as its completely new company and also not got registration number but I have got the enrollment number for my company. If we have to ,may I know the procedure how to pay directors tax who is not drawing salary from the company. Thanks in advance

Hi Ayilavan, thanks for asking us to help you in matters. As you mentioned in above query, for that we’re sharing here only the helping points with you in below statements:

1. First thing is that you’ve no employee in your current company, not required to deduct any professional tax for them.

And while you’ll be hiring employee for your company, at same time you’ve to do it.

2. The second thing is that you’re not getting any salary from your recent OPC Company; so no need to pay any professional tax for yourself.

But if your annual income meets the income tax slab, you’ve to pay the tax yearly on your income. This would be calculating as your direct tax whenever you take the profit from company not as salary.

3. In third thing you are running a business in Karnataka, as per Karnataka profession rules; you’ve to pay annually Rs. 2500 to state govt. for doing business in a regional state.

To get more details on professional tax, returns, income tax return and TDS, contact our expert executives they will guide you in proper way.

I am paying Rs. 2500/- through e-payment system of Karnataka Commercial Taxes.

Any return to be filed or only payment is to be made for PTEC?

See, you’ve not mentioned that you are a Company/LLP/Partnership or Individual/Proprietorship.

The thing is that PT is applicable for business those who are coming under the following categories:

Hi. I have newly registered a llp firm.

I registered for PTEC and filled up the forms and made the payment of rs. 2,000 too, but i have neither RECEIVED any acknowledgement number nor an ec number. all i got was a ctd number. when i try to download the ec, it asks me for a ptr number which i don’t have.

i was able to register and download the PTRC properly though.

can you help me with what i am doing wrong?

We understand your problem. You are not able to download the EC (Enrollment Certificate). That’s why we want to know that how you did your PT enrollment. If you mention the process that you’ve done for your filing of PT enrollment application, we can help and guide you to come out from that.

See, the thing is that when you apply for PT enrollment application, you’ve to follow the process mentioned in Form. And after making the payment, you’ll receive the Acknowledgement Number/ PTR No. which will help you to download the PT enrollment certificate (EC). So could you please, let us know that?

Hi,

I am a registered Self-Employeed professional in Karnataka. But Now I am just a salaried Employee. I want to know the process of cancellation of my registration as a consultant.

Hello Amit Devanand,

Thanks for asking us to assist you. We understand your state of position. You might be joined in an organization wherein they’ll deduct and take care of your professional tax. And you want to cancel your PT registration.

Hence, there is no certain procedure for PT cancellation. Why we’re telling you this? Because after you log in e-Prerana site through your registered Username and Password, you don’t get any “cancel” option there. So, no need to pay professional tax next year onward.

But we’re suggesting you to submit an authorization letter in PT office would be better for future purpose. Otherwise you may get notice from PT department side.

If you need more help, contact us right now. Thanks

Hi Patson,

You have given wonderful knowledge to your users and written in nice way.

And you’ve also shared a link of Enterslice, very useful information.

Thank you

Thanks you so much Sanjay Kumar, we appreciate your kind words.

You know this digitization time is a worthy notion and most of the people are searching online to get a better product or service. So we are trying to share the most relevant and authentic information in our niche to build a high-level transparency in legal services by using the technologies in consulting services.

And here we’re giving space for others who have shared the most helpful information in their niche.

I actually added your blog to my favourite and will look forward for more updates. In this article, you’ve shared the most accurate information on professional tax which is exclusively based on the Karnataka PT Act. Great job, keep it up.

First of all let me tell you, you have got a great blog. I am interested in looking for more of such topics and would like to have further information. Hope to see the next blog soon.

Thanks Himani for your valued words. We are so glad that you found this article and got some valuable information about it. We also wish some other people and professionals could find this article and know more about professional tax.

Your every word is effective and helpful. It encourages us to get more active and productive so that we can provide some good and relevant information on certain topics. We are trying our best to come out with a next topic with good details. Please keep faith with us.

How I can enroll my company online?… I am the first time user.

Thanks Rohit, for asking us to know about how to enroll a company online for professional tax under Karnataka PT department.

This can be done only through the Karnataka e Prerana website. But here’s two things are arising for company i.e. (a) Enrollment and (b) Registration. So who has to do enrollment and registration?

a) For the case of Enrollment – the company is doing business in local state (Karnataka); but has no employees, then it has to do only enrollment. And here the business entity has to pay Rs.2500 annually.

b) For the case of Registration – the company has employees and doing business in local state has to do both enrollment annually and also registration to pay professional tax of employees.

You could go through the “PT registration process” paragraph of this article, will get a clear-cut idea on both “Enrollment” and “New Registration” where we discussed it in a short manner, please follow that.

And we are preparing a step-by-step process articles for both PT enrollment and registration, which could be more effective & helpful to you.

To get more information contact us, so our professionals can help you to discuss the details about it.

I have to register….for enrollment. For that I will go on enrollment application…& for registration I will go on new rc request..plz help

Yes, that exactly same. You’ve to visit the website and if you want to enroll, go for enrollment and/or registration. You have to apply through the site and visit to the department. If you’re unable to do such things on internet and with the department, can take a help from the experienced professionals like us. Thanks

Yes. That’s correct. I am here to share my thoughts on professional tax registration.

Professional tax is levied on all types of trades and professions in India. It has to be paid compulsorily by every staff member who is employed in any private firm operating in India. Professional tax registration is the onus of every business owner, who must take up responsibility for deduction of professional tax and payment for the same.

Professional tax is a state-level tax that applies to salaried employees and professionals, including chartered accountants, lawyers, and doctors. Any professional who gets a regular income on a monthly basis will have to pay the professional tax. By the term professional, we imply people working in specialized fields like accountancy, media, medicine, information technology, media, etc.

The following individuals are exempted to pay professional tax:

– Parents of children with a permanent disability or mental disability.

– Members of the armed forces, including members of auxiliary forces or reservists, serving in the state.

– Individuals, over 65 years of age.

– An individual who is physically challenged (also visually challenged).

– Women exclusively engaged as agent under the Mahila Pradhan Kshetriya Bachat Yojana or Director of Small Savings.

– Parents or guardians of individuals who are mentally challenged

– Badli workers in the textile industry.

To know more about PROFESSIONAL TAX registration, click here: https://vakilsearch.com/professional-tax-registration

Thanks Harish Rajendran, for a nice and informative remark.

We appreciate your worthy sharing. Every bit you mentioned in this comment section regarding professional tax is really helpful and useful for professionals and business organization. And you kept some points on PT exemption that are very factual and it is coming under the PT Act & regulation; and they’re liable to exempt from professional tax.

Nice stuff! Thanks for sharing such a great post. Professional Tax is the tax collected by state government which will be applied to salaried employees and professionals like chartered accountants, lawyers and doctors etc.

Hi

Greetings! Just needed to know what payments have to be made while filing annual returns.

thanks and regards

paul

No need to pay government fee for filing annual returns of PT. This is a yearly acknowledgement for monthly PT Return.

Means the deduction you made monthly basis on professional tax as an employer in a financial year that need to be filed as one annual return yearly for PT and that has to be filed in Form-5. And for this the employer hasn’t to pay any fees to state govt. PT department.

In case you’ve not paid the exact professional tax at the time of monthly filing as per the number of your employee, it’ll reflect the balance amount in annual return acknowledgement while you’ll be generating it. And that time you’ve to pay the balance amount and file return.

Where is this tax depicted after being paid.. In employee form 16 or 26as… Please clarify

Thanks

After PT being paid, it will go to state government department and displayed on company account on employee name. It is clearly outlined in Form 16.

The employer (company) has to provide Form 16 to employee regarding tax or any standard deduction on salary. So the employee can know how much amount has been deducted from his/her account in a financial year.

And after PT deduction, the balance amount for a year can be count as for Income Tax Return (ITR) filing.

But Form 26AS is an annual tax credit statements maintained for tax payer. Form 26AS contains details of your tax paid and tax refund that have been received by you during a relevant financial year.

But remember paid tax on professional tax you won’t get any refund.

Thanks for sharing this valuable information with us. It is really a helpful article! I really appreciate the work you have done, you explained everything in such an amazing and simple way. Keep sharing such articles!

Hi Team,

I am trying to register using new rc request wherein I am unable to register without adhaar as it says “adhaar not verified”. In case, I try to proceed through adhaar, I am getting an error page, please help as to what should I do now.

The first thing is that in case of Karnataka professional tax, Aadhaar is not required for New RC Request. Why you’re applying through Aadhaar?

Secondly, don’t apply New RC Request by choosing the option “verify Aadhaar your info”. Leave it by-default as No option.

To apply New RC Request, company’s/partnership’s/proprietorship’s PAN, Mobile Number and other business details are required. Please refer the document section which we’ve mentioned in this article.

Thirdly, to overcome the error message, you just have to enter Plot No., Building, Street in “Address of the Firm” field with limited character; then error message won’t come and it will proceed for next step. You can apply it smoothly.

For more details contact us, we can help you to complete your PT registration.

Very useful and informative.

Thank you so much for your valued words.

Hi, can we pay PT for DIFFERENT states employee in karnataka eprana? if yes which and all state PT can be paid through karnataka Eprena.

You can not pay professional tax for other state employee in Karnataka; because PT is a state based tax and every state has its own tax policy. e-Prerana portal is built for Karnataka PT. Professionals and businesses tax payers can deduct their employee tax through e-PRERANA.

Thanks for sharing this great post. It’s really awesome and useful for professionals & business organizations.

Hii,

I am trying to do pt registration for our bengaluru office. But, after completion of all process, one error was showing there. The error is PAN no. not verified. Please help me this issue.

To overcome this issue, you’ve to enter the company/entity PAN number in specified “PAN” field and click on “Verify PAN” button. After verifying PAN, fill all the details of firm and applicant then proceed for Next.

hi, how to change user id login of professional tax in website (I.e) e-prerana ????

In e-prerana website, there is no option to change Username of login data online. So you can’t do it through online. You’ve to go to the department and consult with the officer regarding this issue. And they’ll guide you in the same process.

We have forgotten our login password of registered PT. How to reset it (registered user from Karnataka)?

Simply, you can reset your password online through this way:

1. Visit to e-prerana site.

2. Click on “Registered User Login” from the left panel.

3. Click on “Forgot Password” link. Enter Username and click on Submit.

4. Then a link will come to your registered email. Click to that link & set your new password here.

Otherwise, you can visit to the PT department and get your new password from office.

Hi,

First of all, I appreciate your efforts. I loved your post because you have written it in a user-readable way. Looking ahead for more content. Thank you for sharing this valuable information with us!

Thank you so much Mamata, for your valuable words and suggestion. We are thankful for your cordial comment.

I’ve a llp company registered in Karnataka state from 1.4.19. Do I have to Pay PT Tax of 2500? And llp partners also need to pay PT of 2500?

Also I have 3 employees above salary of 15000. So do I have to file monthly professional tax return and monthly payment? And yearly return also?

Firstly, as an LLP company; yes, you’ve to take the PT enrollment certificate from the department by paying Rs. 2500.

Secondly, no partners have to pay Rs. 2500; as the company is paying off it. Then get PT registration certificate for the purpose of monthly & annual PT returns right.

In third, you’ve to deduct Rs. 200 professional tax from your every employee salary and file it monthly return. As your 3 employees salary has above Rs. 15000.

In fourth, yes, the company/entity has to file monthly professional tax return and yearly one return also.

if I have multiple offices in Karnataka, do I need separate registration for each office? thanks in advance.

You don’t need individual registration for running multiple offices.

If you’ve more than one branch offices in Karnataka; you can take one registration under the head office (main branch). And add other business offices under the main branch as additional business places in Karnataka PT department.

At the time of adding the other trade centers, you’ve to upload the certain documents such as:

1. Electricity bills

2. Address proof of business places

3. NOC from premises owner

4. Business registration proof (Company/Partnership/Proprietorship)

5. MOA & AOA and etc.

Hi,

appreciate your response, our head office is located in Chandigarh, but branch office at bangalore in that case

1. I have to register pt here in bangalore or not?

2. even if i register here, I have to show my head office while opting for registration as it is from different state.

Thanks in advance

Thanks so much Samuel for asking about your doubt.

Regarding your first point; yes, you’ve to register under the Karnataka Profession Tax Law. Because you’ve branch office in Bangalore and you’re doing business in this region.

Regarding your 2nd point, you can mention your head office address at the time of Karnataka PT registration and it’s a branch office.

HI, Your blog is really nice and I appreciate the advice and clarification shared by you. I wanted to know if a company has multiple places of buisness in karnataka, and has 1 PT registration, do they need to pay 2500 for each additional place of business annually ?

Thanks Nitin for your valued comment on this post. Your words are treasure for us.

We want to make sure you that a company having multiple business places in Karnataka needs to pay Rs.2500 annually for each additional business place as per its Professional Tax Act.

Hi,

Very well written article. Thanks for sharing such information. We have following query:

There is a Private limited company AND it’s monthly professional tax liability is less than Rs 5000 . As per rules, in case tax liability is less than rs. 5000 so we shall be allowed to file quarterly return BUT PT site is not allowing to file returns quarterly, we r not able to choose quarterly option. So what to do in such case. Please suggest.

Thanks Trupti, for your rewarding comment.

We understand your difficulties. We think, it’s a website issue or a misunderstanding may have happened to PT department and site developer. That’s why you’re not able to select the quarterly tax liability option.

Otherwise, you can contact to tax department people for help. We’re searching for solutions. If we got to know will inform you quickly.

Hi

I paid interest u/s 11(2) at the time of payment of monthly professional tax liability, now when i filing annual return there is no option to show interest payment but when i entered it into interest payable it shows outstanding liability, please suggest how to adjust it.

Thanks in advance

Thanks Rohit, for asking a nice query. Till now, we’ve not faced this issue regarding on interest payment. We’re finding the loophole and get back you soon. Otherwise, you can contact to department; they’ll guide you.

Is professional tax is applicable for private universities and EDUCATIONAL INSTITUTIONS STAFF AND TEACHERS?

As far as Karnataka Tax on Profession Act, up to 12th standard institutions or pre-universities and its staffs and teachers are exempted from professional tax.

Hi sir, I have a small Shop in my small city should I pay PT

No need to pay PT.

While making annual payment of Rs. 2500 through this https://vat.kar.nic.in/epay/ProfessionalTax/ProfessionalTax.aspx

Tax period will be selected as 2020-21?, if we are paying now?

Yes, we’ve to select the financial year period 2020-21 while filing the annual payment.

We have started our office in Jan 2020 but we got registered only in month of July 2020 with effective date of JAn 2020.

Now to pay tax from Jan 2020 the overdue interst has to be calculated manually or site will automatically calculate and tell us when make payment for JAn2020

In this case, 3 options are there

1. You can calculate the interest as 1.5 percent and file out it.

2. File PT return what you want to do file, then PT Department will intimate you by email or post for the next step.

3. Communicate with the concerned PT officer to get the clear idea on it.

Wow! What a nice post? I’m impressed very much with the useful information. And a great discussion threads are very helpful. I got the points for what I am searching for. Really, this is a very good blog post. Keep sharing the values.

This article is actually remarkable one it helps many new users that desire to read always the best stuff.

Different states have different laws on professional tax i.e. rates and methods of collection. The maximum amount of Professional Tax that can be imposed by any state in India is INR 2500/-. In India, not all states impose professional tax. Some of the States have made available online mode of payment of professional tax. The Professional Tax is a source of revenue for the state governments which helps in implementing schemes for the welfare and development of the region.

Thanks for the points you briefed on professional tax.

Hi,

We have started a LLP with 2 partners in this year. I have got Enrollment certificate by paying Rs 2000. And We don’t have employees, but still I have registered for the same and for registration certificate. Are there any other PT registrations to be done? Please confirm!

Hello Anand,

It’s fine that you’re paying PT Enrollment fee for your company or business as per the rules and regulations of state profession tax. But, we recommend that don’t go for PT registration certificate; unless your employees draw the salary of Rs 15000 or more.

Hi, We have changed our LLP name. Kindly let us know the proceedure for changing the name & Address in pt registration. Thanks in Advance

Thank you for being concerned, its very nice to ask us.

You can go through this method to make changes of your company details in PT registration:

1. Visit e-PRERANA site and login with your Registered User Login

2. In dashboard, click on Amendment section and fill the details of your company

3. Upload necessary documents and click on verify

4. Then click on Submit

Professional Tax contains great information on tax registration. Really, this is a very useful and helpful post. By scanning the comments and scrolling to down, I found the super discussions giving live to this post.

Om Sai Management Consultant executives counseling is one of the main stages for obtaining different business-related administrations and getting an appropriate line of work for you. We have been exceptionally the best work and business-related specialist co-op.

Thanks for sharing very good information.

Need to clairify one thing. our’s is a pvt company and even after making the payment of 2500 towards EC payment , in form 2, it is printed as ” The above statements are true to the best of my knowledge and belief. I will make the e-payment before due date to get this application acknowledged and EC No generated”.

whom should we contact to correct this? or is there any way we can correct it online

After doing payment of Rs.2500 for the Enrollment Certificate, you’ll be able to get the PTR No. and through this, you can download the PT certificate. If you’ve not got the PRT No., then you might have made a mistake somewhere. So visit the department for better clarification and solutions. Otherwise, you can contact us we’ll help you in this matter.

hi,

We have head office in Bangalore, our few employees are working at client place in Tamilnadu. we do not have any office in Tamilnadu. Professional tax for these employees will be come under Tamilnadu or Bangalore.

As you mentioned, few of your employees are working at the client place of Tamil Nadu are your employees; not client’s employees. Mean you’ve deployed them for your client-side work. And your office is situated in Bangalore; not in Tamil Nadu. So the professional tax for these employees is come under Karnataka Profession Tax.

Hey, i am registered for professional tax in karnataka and now i want to cancell my pt registration. how do i apply for cancellation of pt certificate.

Sorry for delay in response. You’ve not mentioned why you want to cancel the PT certificate. But, you can follow this way to cancel your PT registration.

There is no certain online process for PT cancellation. For that, you have to visit the PT office and submit authorization letter regarding cancellation along with respective documents. And you’ve to do it through offline way.

Wow! This can be one particular of the most helpful blogs We have ever arrive across on this subject. I am satisfied with your Profession Tax points. Actually Great. I am also an expert in this topic therefore I can understand your hard work.

Thanks for your mention! We appreciate your words and thinking. Really, you’re a game changer. Keep going on …

Thanks for sharing this informative blog with us

GST registration consultant

Hi, Is it necessary to update the company address in PT , if it is changed? if yes, what is the process for updating the company address.

Yes, you must have to update the changed address of your company in PT portal.

The process is easy and simple. And you can do it through online.

Here are the steps to follow:

1. Visit e-PRERANA site.

2. Click on “Registered User Login” and login through your credential.

3. Click on “Amendment”, you’ll see your company details here. And you’ve to replace only the present address regarding old address and upload respective documents.

4. Then click on “Update”. That’s it. Your address will be updated.