The term NSIC stands for National Small Industries Corporation. It is an authority of the Government of India and is under the aegis of the Ministry of Micro, Small, and Medium Enterprises (MSME). NSIC helps to promote, foster, and aid the growth of the MSME businesses in India. For this, it operates a wide variety of programs such as the following:

- Single Point Registration Scheme

- Marketing Intelligence

- Consortia & Tender Marketing

- Raw Material Assistance Scheme

- Procurement Marketing Scheme

- Procurement and Marketing Assistance Scheme

- Performance and Credit Rating Scheme

- Infomediary Services

- Bill Discounting Scheme

- Skill Development Service

- Credit Facilitation by Banks

In 1995 NSIC was set up by the Indian government. It presently holds the ISO 9001:2015 certification, and it is a Mini Ratna PSU (public sector undertaking).

Benefits of Getting NSIC Registration

The benefits of registering with NSIC are enumerated below:

- You can get tenders without paying any money for the same

- It helps you progress as a small-scale industry

- It makes you a lot more proficient as an MSME

- You get some leeway in the government tenders

- You get invaluable assistance from different support services

- You get to choose from various consultancy services

- You do not have to pay any EMD (earnest money deposit)

Eligibility Criteria for NSIC Registration

These are the most entitled criteria of SPRS registration.

- Every Micro and Small Enterprises (MSEs) involved in manufacturing & Services are eligible for NSIC (National Small Industries Corporation) registration.

- The MSE start-ups already started their commercial production, but not completed one year of existence are eligible for NSIC Provisional Registration for one year. MSEs can apply for full registration through Single Point Registration after completion of one year.

- All MSEs (Micro and Small Enterprises) having EM Part-II/ Udyog Aadhaar Memorandum (UAM)/ Udaym Registration are eligible for NSIC registration.

Process Involved in Getting NSIC Registration Certificate

Companies in both services and manufacturing sectors can register for the same as long as they are an MSME or have registered for the Udyog Aadhaar program.

To register with the program, the applicants have to send an online application. Else, they may also visit an NSIC office and submit their application over there. Whenever an application is submitted, it gets forwarded by the NSIC to a zonal, sub-branch, or branch office. It is decided based on the proximity to the applicant. It helps with the completion of the technical inspection of said unit. It is after the inspection that they forward the recommendation for registration with the NSIC. When the NSIC gets the inspection report, it provides registration to the MSME unit that had applied for the same.

Process of NSIC Single Point Registration

Before doing Single Point Registration, it is advisable to go through the checklist and download section for knowing about which forms, annexure and documents required.

- Get Udyam Registration for SME first

- Register in MSME Data Bank using Mobile No, UAM No and PAN to get registered for Single Point Registration

- Fill 7 steps of Single Point Registration and proceed each step with Save and Continue

- Make payment on the basis of Enterprise category (Micro or Small)

- Third party inspection will be carried out for unit verification. Units are requested to choose inspection agency according to their domain expertise and jurisdiction.

- SPRS Certificate will be available online, you can download it. NSIC office will send physical Certificate copy to your address by post.

Documents Required for NSIC Registration

The following documents are necessary to register for NSIC:

- Copy of MSME registration acknowledgment

- Copy of type test reports from independent labs – this is applied as per the relevant standard.

- Details about plant along with raw material and machines plus the original price of purchase

- Copy of latest electricity bill

- Performance statement

- Audited balance sheet, profit & loss statement, and trading account

- Self-attested lease deed copy or copy of ownership documents of business premises

- Account-related information for the previous three years signed by an authorized person using their official seal

- Certificate or declaration from the proprietor, director, or partner regarding their connections with large-scale units or lack thereof

- Statement on results of operation for the previous three years – it must be signed duly by a chartered accountant using their seal

- List of finished goods and raw materials in stock

- Report from the banker providing details of the financial status of the firm that has applied – this needs to be as per Performa F in the application form

- copy of BIS (Bureau of Indian Standards) license if necessary

- copy of PAN (permanent account number) card

- copy of ISO (International Organization for Standardization) 9000 – this is optional

- Partnership deed

- List of technical employees working in services and production

- Form A from the Registrar of Firms shows the names of the partners

- Items for which registration required along with specifications in detail

- Certificate of incorporation

- Write-up on quality control measures followed by the applicants to make sure that the raw material is of high quality – this is also applicable for the likes of bought out items for sub-assembly and assembly, finished products, and stores & products in the process

- Articles and memorandum of association

- List of testing facilities and quality control equipment available in the factory

Charges Applicable for NSIC Registration

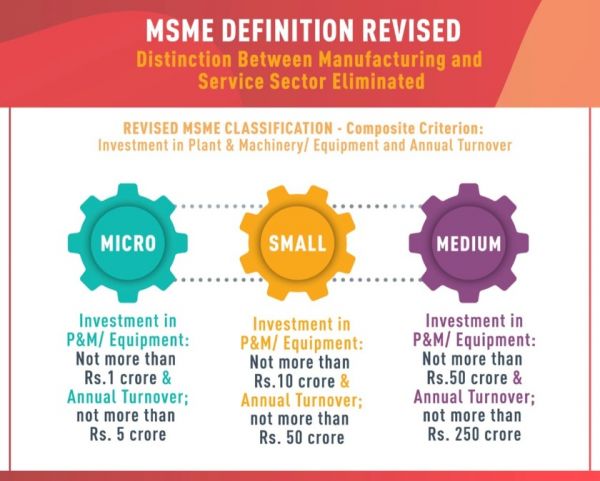

The total money you pay to register with the NSIC is based on your MSME classification and the annual turnover of your business. If you are a micro-enterprise and your turnover is less than a crore, you would have to pay a registration fee of 3000 rupees. However, if it’s a small enterprise with a turnover of more than a crore, you need to pay 5000 rupees for registration. If you are a micro-enterprise and your turnover is more than one crore, you would have to pay 3000 rupees along with 1500 rupees for each extra crore.

If you are a small enterprise with a turnover exceeding one crore, you would have to pay 5000 rupees along with 2000 rupees for each extra crore. The registration fee cannot exceed 1 lakh rupees. Inspection charges are applicable in these cases as well. The fees decided by the agency are for said inspection. The small enterprises usually have to pay 3000 rupees, and the micro-enterprises have to pay 2000 rupees for inspection.

The final fee charged is the professional fee. The fee is paid to the RITES Limited and Consultancy Development Centre – the money paid is for the physical inspection it will undertake. The micro-enterprises have to pay a professional fee of 6000 rupees, and the small enterprises have to pay 8000 rupees for the same.

Validity and Renewal of Registration

The validity of NSIC certificate will remain for 2 years of time period from the date of registration. And the MSEs can apply for renewal before 3 months of SPRS Certificate expiration. Facilities are available in NSIC Scheme. To get the benefits of this scheme, the enterprise owner can renew it in every two years thereafter and enjoy the scope of business management and marketing.

A good decision is taken by NSIC department, offering 50% discount on renewal fee for MSEs those who are coming before the expiry of SPRS certificate.

How can PatsonLegal Help You?

PatsonLegal is one of the best platforms to fulfil the dreams you have in this regard. It would coordinate everything for you and deal with all the financial and legal requirements in this particular case. It would connect you to all the right people so that you can get such registration done without any problem at all. They would make things simple for you, thus making it easier for you to understand the entire process.