As per the Companies Act, 2013 a public limited company is one that has limited liability and also offers shares for the common people. Anyone can buy the stocks of such a company. This can be done privately by way of an IPO (initial public offering) or through trades in the stock market. A public limited company has to be regulated strictly and it also has an obligation to provide proper information regarding its financial health to its shareholders.

Before doing registration of public limited company, the organization should know, understand and clear about the features, advantages, requirements and process so you could proceed for next step. And the most important thing is hiring the right consultant could be benefited, so they can guide you and support in your journey.

What are the characteristics of public company?

As has been mentioned in the provisions of the Companies Act, 2013; you need at least 3 directors in order to start such a company. So you need a minimum of 3 directors. There are no restrictions on the maximum number of directors that you can have in such a company.

The second characteristic of such a company is limited liability. Each shareholder has limited liability with regards to such a company. In layman’s terms this would mean that no shareholder over here is responsible personally for any loss that the company has suffered or any debt that it may have incurred. They are only responsible for the amount that they have invested in the company.

This makes such a company different from other kinds of companies such as partnerships and sole proprietorships where the business owners and partners are responsible in many ways for the debts incurred by the business. However, this does not mean that the shareholders of such a company are immune to any loss or debt of the company in question. They will always be held accountable for any illegal step they may have taken in the regard.

There are some requirements related to paid-up capital over here as well. As per the rules such a company needs to have a minimum paid-up capital of INR 5 lakh.

These companies are mandated by the laws to issue any prospectus for the common people. This is the simple reason that’s why they’ve given permission to invite people to buy their shares if they want.

The Companies Act, 2013 also makes it necessary for them to add the word limited at the end of their name.

What are the advantages of public limited company?

One of the biggest advantages of a public limited company is that it has access to more capital. This is because it can offer its shares to the common people. This means that anyone can invest in such shares. This in turn improves the capital at the disposal of such a company as well.

Such a company also gets a lot more attention and this is for the simple reason that it happens to be listed on the stock market.

This is the presence that garners of such company get attention from the likes of hedge funds and mutual funds as well as other traders who are always keeping an eye out for the business performance of such a company. This in turn leads to better business opportunities for such a company.

These companies are also able to spread risk a lot better. This is because they sell their shares to the common people and this is how they are able to spread out the unsystematic risk of the markets.

Since these companies have lesser exposure to risk they have better opportunities for growth and expansion. In fact, they have the perfect opportunity to do so. They can easily generate money with the help of the shares and use it to invest in new and exciting projects.

What are the criteria for registering a public limited company?

The Companies Act, 2013 has prescribed a number of rules and regulations in order to form a public ltd company.

You need to have at least 7 shareholders and 3 directors. You also need a minimum paid-up capital of INR 5 lakh. One of the directors has to have a DSC (Digital Signature Certificate). It would be needed when you submit self-attested copies of the address and identity proofs of the directors.

The directors should also have a DIN (Director Identification Number). You would also have to make an application in order to choose the name of the company in question. You would also need to make an application where you put the primary object clause of your company.

The object clause would state what the company would do after it has been incorporated. The application would have to be submitted to the ROC (Registrar of Companies) along with documents that are needed in this case such as MOA (Memorandum of Association) and AOA (Article of Association).

You would also need to fill up some forms – DIR – 12, INC – 22, and INC – 7 – properly and submit them along with the application. You would also have to pay the prescribed registration fees to the ROC.

After you are able to get the necessary approval from the ROC you would have to apply for the certificate of business commencement.

What are the documents needed to form a public ltd company?

You need to prepare the following documents in order to incorporate your public limited company:

- Identity proof of all directors and shareholders

- Address proof of all directors and the shareholders

- DSC of all the directors

- DIN of all the directors

- PAN (Permanent Account Number) of all the shareholders and directors

- MOA (Memorandum of Association)

- Utility bill of the proposed registered office for the company

- AOA (Articles of Association)

- An NOC (No Objection Certificate) from the landlord of the premises where you would be setting up your office

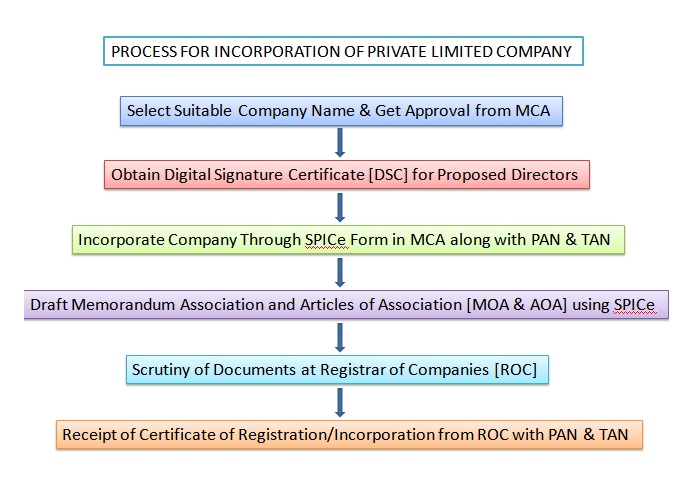

What is the process for registration of public limited company?

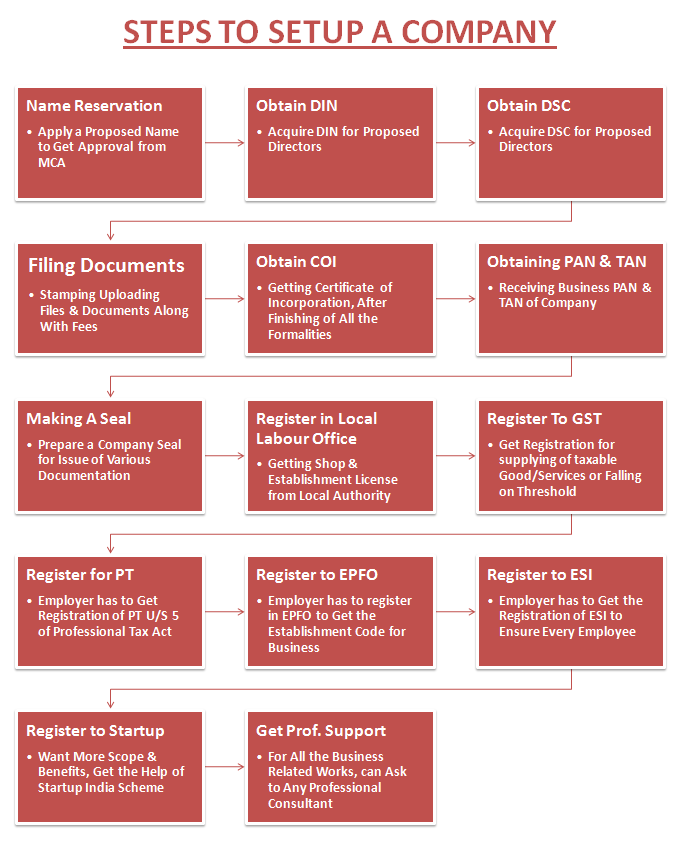

See, these steps are required to get incorporate a company:

- Choose a new and unique name

- Apply for company name approval

- Obtain approval from MCA department

- Apply digital signature for directors

- Apply DIN for directors

- Prepare MOA & AOA

- File forms & documents for incorporation

- Get COI of company

In the first step of the process, you need to choose new fresh name of the company and get approval for that. The name has to be a unique one. It should not be same in any way, shape, or form to a company that already exists.

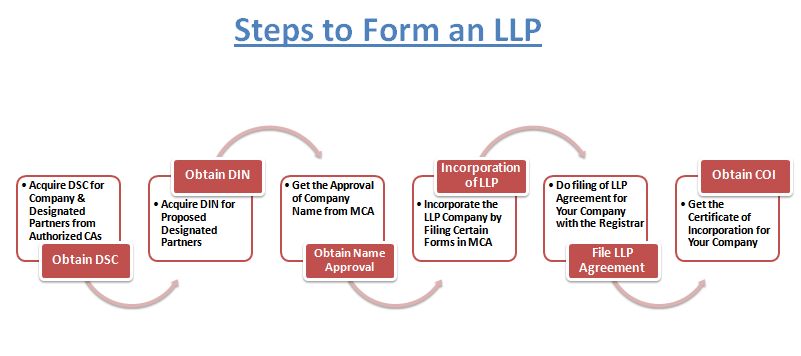

The same also goes for trademarks during selection of name on private limited company, LLPs (limited liability partnerships) and OPC as well. So, choose wisely.

In the second stage of process of public limited company registration in Bangalore you have to file your application for company incorporation online. At this stage the digital signatures are issued by the relevant authority.

In the third stage you would have to file for incorporation. In this case you would have to fill up Form Spice 32. Once this is approved by the concerned authority your Certificate of Incorporation would be issued.

In the final stage you would have to deal with areas such as PAN, bank account, and TAN (Tax Deduction and Collection Account). It is the IT (Income Tax) Department that would allot TAN and PAN. The same would be mentioned on your Certificate of Incorporation as well. Once you get them you would have to concern yourself with opening the bank account.

Getting expert support and guidance

Now, as you may have seen, the process of public limited company registration is not an easy one at all. In fact, it is unlike anything else you may have ever done in your life earlier on. This is why you need experience and expertise professional in order to get the work done and that too in the best way possible. This is where the companies that specialize in such work can come in and play such an important role in every sense of the term.

So we are Patson Legal Company would be able to help you for the simple reason that we have been in the field of business industry for quite 8 years time now and fix your problem with easy techniques. We have been there and done that for plenty of companies such as you.

Rest assured we would be able to assist you with the incorporation of your public limited company as well for others also. You can be sure that with our help & support there would be no mistakes at all, something that can happen if you attempt such a task all by yourself.

You can also be sure that we would be able to complete such work in lot less time than what would have been possible for you.