MSME Registration: Classification, Documents, Process & Benefits

The term MSME is an abbreviation of micro, small, and medium enterprises. As far as a country like India, whose economy is still in the developmental stage, is concerned these industries can be regarded as the very spine that supports the economy as such.

It is said that around 45 percent of the total industrial employment of India is directly contributed by these companies. They also account for half of all the exports made by India and make up 95 percent of the total industrial units in the country. As per statistics provided by the MSME (Ministry of Micro, Small, and Medium Enterprises) is concerned these companies make around 6000 different kinds of products.

It can be said for sure that with the growth of these companies the country grows as well. These industries are also referred to as SSIs or small scale industries.

How are MSMEs Classified?

The MSMEs in India are classified by the MSME Act, 2006 that came into being on 2nd October that year. The main aim to establish this act and the ministry was to make sure that MSMEs could be promoted, developed, and fostered so that they could be more competitive.

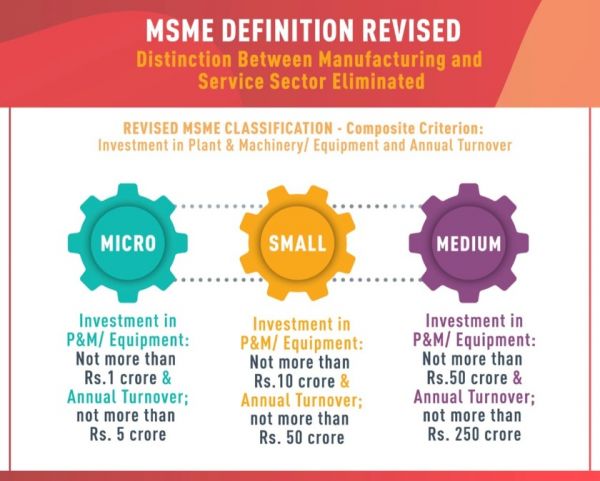

Recently, Government of India has planned to change the definition of MSME by redefining its classification, and providing some special benefits to the entities to push up their competitiveness, sustainability and growth.

Now, they are broadly present in two sectors – Service and Manufacturing same as earlier classification. But, they are normally categorized in terms of the investment and annual turnover. Means what they’ve invested in plant & machines for manufacturing industry, and earnings annually for service industry such as:

- Manufacturing enterprises – Investment in plant & machinery

- Service enterprises – Annual turnover

Manufacturing industries are categorized on the basis of their amount invested in plant and machinery:

- Micro enterprises: These businesses are one that could be invested less than INR 1 crore;

- Small enterprises: These businesses are one that could be invested between INR 1 crore and INR 10 crore; and

- Medium enterprises: These businesses are also one that could be invested between INR 10 crore and INR 20 crore.

In the context of service sector, these industries are also categorized on the basis of their annual turnover:

- Micro enterprises: These businesses are one that could be invested less than INR 5 crore;

- Small enterprises: These businesses are one that could be invested between INR 5 crore and INR 50 crore; and

- Medium enterprises: These businesses are one that could be invested between INR 50 crore and INR 100 crore.

Existing MSME Investment chart as per Ministry of Micro, Small & Medium Enterprises

| Enterprises | Manufacturing Sector | Service Sector |

| Investment in Plant & Machinery | Investment in Equipment | |

| Micro Enterprise | Doesn’t exceed Rs. 25 lakh | Doesn’t exceed Rs. 10 lakh |

| Small Enterprise | More than Rs. 25 lakh but doesn’t exceed Rs. 5 crore | More than Rs. 10 lakh but doesn’t exceed Rs. 2 crore |

| Medium Enterprise | More than Rs. 5 crore but doesn’t exceed Rs. 10 crore | More than Rs. 2 crore but doesn’t exceed Rs. 5 crore |

Revised MSME Classification Scheme

| Enterprise Classification | Manufacturing Sectors | Service Sectors |

| Based on Investment | Based on Turnover | |

| Micro | < Rs. 1 crore | < Rs. 5 crore |

| Small | < Rs. 10 crore | < Rs. 50 crore |

| Medium | < Rs. 20 crore | < Rs. 100 crore |

Role of MSMEs in India’s Growth

The key role of MSMEs are vast, here we have just mentioned only 6 points:

- To generate large scale employment opportunities in India at low cost capital

- To provide maximum opportunities for both self-employment and wage-employment

- To create flexible environment to ensure competitive innovation

- To enhance the regional social structure and its development

- MSME sector contributes enormously to the socio-economic development of the country

- To build an inclusive, sustainable and equitable livelihoods of society in innumerable ways

What are the Benefits of Registering Your MSME?

There are several advantages of registering your MSME. Here are the top 6 key benefits of MSME registration comes from government side:

- First of all, when you do this you can get bank loans at much lower rates of interest. In fact, it can get to as low as 1 or 1.5 per cent. As you would know this is much less than the rate of interest applicable for repayment of normal business loans.

- You also get a number of tax rebates as well.

- You also get credit facilities for minimum alternate tax (MAT). This can be taken up to a maximum of 15 years instead of the normal limit of 10 years.

- As an MSME you also have the sole right to apply to a number of tenders issued by governmental agencies.

- You also have quite easier access to credit. This way, you also get a number of concessions and rebates that help you set up your industry or even perform business related work such as registering a patent.

- You would also get better preference when it comes to various certificates and licenses issued by the government.

What are the Documents Needed for MSME Registration?

Here are some essential documents we required to get the information about the organization and its activity:

- Aadhaar Card of entrepreneur is must required

- Proprietorship PAN Card is must required, if it is sole proprietorship firm

- Company PAN Card is must required for Pvt Ltd/ LLP/ OPC/ Partnership

- Certificate of Incorporation (COI) of company

- Address proof of business place

- Bank details (A/C Number, IFSC code)

- Nature of the business

- Investment of capital in business

- Number of employees working in your organization

Normally as a business entity in these cases you need to furnish your business address proof, copies of sale bill and purchase bill, partnership deed or MoA (Memorandum of Association) and AoA (Articles of Association), and copy of bills and licenses of machinery that you have bought for your business.

If you own the premises you can provide allotment letter, lease deed, possession letter, or receipt of property tax as proof of your business address.

If you have a municipal license in the name of your business or even in the name of the business owner, director, or partner you need not provide any other possession document as such.

If you have rented the premises you may furnish rent receipt as well as a no objection certificate from your landlord. You would also need to submit utility bills or any other document that supports the ownership of the landlord.

As far as copies of sale bill and purchase bill are concerned you have to provide copies of sale bills for each and every product that you are selling. Much in the same way, you also need to provide a purchase bill for each raw material that you have bought.

As far as partnership deed or MoA and AoA are concerned you would need to submit the partnership deed in case you are a partnership firm. Now, if you are registered officially as a partnership firm you would need to submit the registration certificate as well.

In case you are any other kind of company you would have to provide the MoA and AoA. Along with you need to provide your certificate of incorporation as well. In these cases you would also need to submit a copy of a general meeting resolution as well as the copy of a board resolution that has permitted a director to sign said application.

MSME Registration Process

Aadhaar number is compulsory needed for registering your business enterprise online under the MSME, Act; and to get this Udyog Aadhaar registration number you have to apply it through Udyam Registration official website.

However, before going to do registration of your enterprise, keep handy the entire above said documents asides with you.

- Make an application online with the help of your Aadhaar number and Name and generate OTP (remember that your mobile number should be linked to your Aadhaar).

- Make confirmation of OTP which has sent to your mobile. It will be direct you to Udyog Aadhaar Form.

- Fill the form online, from 1 to 21 fields of MSME Registration Form and click on Final Submit button. Then you will get the registration certificate along with your UAM (Udyog Aadhaar Memorandum) number.

We Help You Get Your MSME Your Certificate Instantly?

For registering your MSME in Bengaluru Karnataka or any other cities in India; you will get numerous good agencies in Bangalore. But, if you need our help, we will assist you in this matter as well as other business concerns also.

If you wish to register your small and medium scale industry you would have to first fill up a form. You can do it online or offline as well. If you wish to register for more than a single industry you can go for separate registration as well. The registration form for an MSME is available at the official website of Udyog Aadhaar. There are certain documents that you need to provide along with your application. You also need to fill up some basic information in this form. It may be enumerated as below:

- Personal Aadhaar number

- Industry name

- Address

- Details of bank account

While filling up the form in these cases you can also provide certificates that you have certified by yourself. Keep in mind that this process is absolutely free. You do not need to pay any registration fees for the same. Once you have filled in the details and uploaded the same you would get the registration number and certificate in due course of time.