Know All About LLP (Limited Liability Partnership)

A limited liability partnership (LLP) can be described as a hybrid form of business where you get the flexibility that is normally there in case of a partnership; as well as the benefits of limited liability that are usually associated with a limited liability firm.

It is basically an independent legal entity. An LLP can continue doing business in spite of changes of partners. It can hold property and also enter contracts on its own. As such it is held liable to the fullest extent of its assets.

However, the liability of the partners is restricted to the contribution that they have made in the same.

What is an LLP?

Since an LLP is accorded the status of a body corporate as well as a separate legal entity it has perpetual succession. In an LLP, no partner would be held accountable for any action of another partner that has been taken in an unauthorized or independent manner.

This means that all the individual partners happen to be safeguarded from any joint liability that may be created by the wrong business decisions taken by the other partner. The same can also be said about any misconduct on part of partners. It is the main partnership agreement that governs the mutual duties and rights of the partners in an LLP.

At times, such agreements may also be reached between an LLP and the partners. In that case that particular agreement would be accorded the status of main governing entity. However, since it is an independent legal entity, an LLP cannot be considered to have been absolved of the liability towards its various obligations.

What are the advantages of an LLP?

As this is a form of business, LLP offers a number of advantages.

It is an organized form of business and normally works on the basis of an agreement.

There is a lot of flexibility over here and you also do not have plenty of procedural and legal necessities to deal with over here.

In this business there is plenty of scope to combine technical and professional initiative and expertise with the capacity to take financial risks.

The best part of this business is that all this can be done in an efficient and innovative manner.

Differences between an LLP and a general partnership firm

In a normal partnership firm each and every partner is held liable for all the business decisions and dealings done by the company during her or his presence as a partner.

However, in an LLP the liability is only limited to the contribution that has been made by that partner. On top of that a partner is never held accountable for the bad business decisions and dealings of the other partner as well as the unauthorized or independent decisions that she or he may have taken.

Why is LLP such a popular form of business?

There are several reasons as to why LLP has become such a highly sought after form of business all around. They may be enumerated as below:

- They are easy to form

- Low compliance burden & cost

- The liability is limited

- There is perpetual succession

- It is easy to manage such a company

- Ownership can be transferred quite easily

- There are various tax related benefits

- No compulsory audit is necessary

First of all, it is really easy to form an LLP. It does not take as much time as it does to form a company. Nor is the process as complicated. At the very least you need to pay a fee of INR 5600 to form an LLP and the maximum fee is in the region of INR 9500 or it may be vary as per the requirements.

In an LLP the partners do not have to pay for the debts incurred by the company from their own assets. A partner is also not held responsible for the misconduct or misbehavior of the other partner.

It does not matter if a partner of an LLP dies, becomes insolvent, or retires. An LLP can be closed only as per the provisions mentioned in the LLP Act, 2008. The directors of the company are supposed to decide and manage the company. Shareholders do not have the same power as the directors.

There is no restriction as far as joining or leaving an LLP is concerned. One can get in quite easily as a partner and leave the firm equally easily as well.

It is also quite easy for ownership to change hands in such a business enterprise.

An LLP is exempted from a number of taxes such as the minimum alternative tax and the dividend distribution tax. The rate of taxation applicable for these companies is also quite less than other companies.

Normally a business needs to employ an auditor in order to see if the accounts of the organization as well as its internal management are in proper order or not. This however is not required for an LLP.

An LLP only needs compulsory audit when its turnover is in excess of INR 40 lakh and in cases where the capital contribution is more than INR 25 lakh. There is yet another major advantage of an LLP that has made it such a popular form of business to so many people in India. There is no minimum limit of capital contribution over here.

Who are looking to create such a company?

An LLP happens to be the ideal option for people who are looking for the benefits of limited liability and the flexibility that one gets with a partnership firm. It also helps that the compliance costs for such a company are on the lower side.

If you want to organize your internal management on the basis of a mutual agreement – as happens with a partnership firm – this is the format of business that you should choose. This is the reason; this format is such a hit with the small and medium companies in India.

In fact, this is especially true for enterprises looking to make a mark in the burgeoning service sector of the country. If your business involves hiring professionals then this is one format that you can definitely look into. At least, all over the world that is how things work in this case.

If you are in a business that is sure to be profitable then too an LLP is the right choice for you.

As you already know that there is no minimum standard needed for capital contribution in such a company it would also be the right kind of company for you if you are an entrepreneur, professional and service provider who has a bright and innovative business idea but very little money to form a company as such and execute it in the right order.

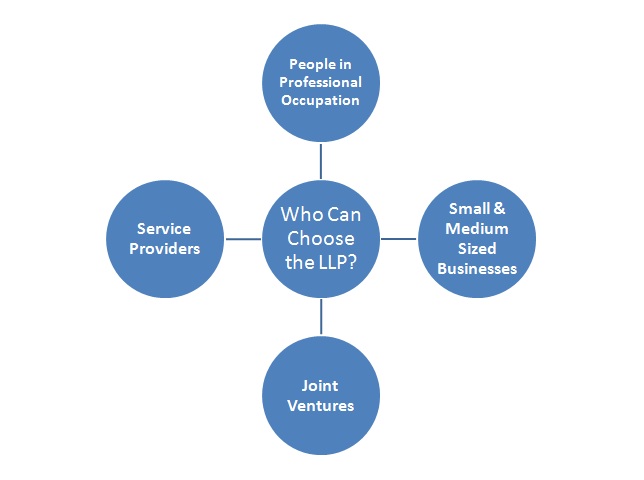

Accordingly, the LLP business vehicle can be opted by the followings:

Who can choose/ select LLP type business structure? – They could be Professionals, Service Providers, Small and Medium Sized Businesses, Joint Ventures and etc.

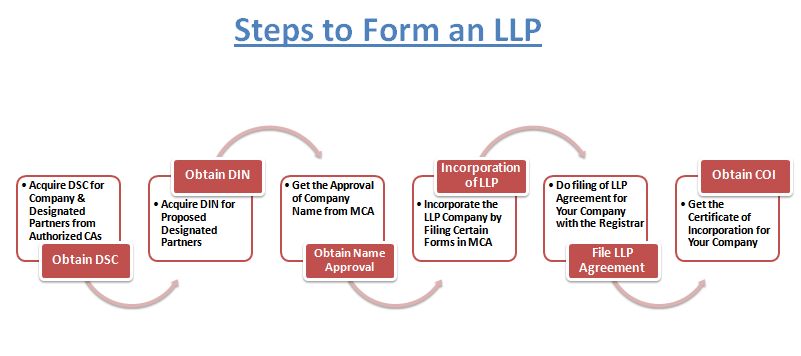

How to form an LLP in Bangalore?

As far as forming an LLP in Bangalore Karnataka or any other cities in India is concerned that there are 6 major steps must required for it. In the first step you have to get the DSC (Digital Signature Certificate). In the next step you have to apply for the DIN (Director Identification Number). In the third step you need to get the name of your company approved and reserved. In the fourth step you have to incorporate the company. In the fifth step you have to file the LLP agreement. In sixth step, you’ve to acquire the LLP incorporation certificate from the Registrar.

To apply and obtain registration for LLP in Bangalore or any other cities in India; you can go for a good and effective agency/ consultant/ professional, so that they can help you to get registered your LLP.

What are the documents required to form a LLP?

For registering a LLP in India, you need to produce these documents:

Documents of Partners

- PAN Card/ Aadhaar/ Voter ID proof of partners

- Address proof of the partners

- Passport sized photographs

- Passport for Foreign National/ NRI

Documents of Business (LLP)

- Electricity/ water bill of proposed registered office

- Rental/ leased agreement copy of business place from property-owner

- NOC (No Objection Certificate) from landowner

- DSC (Digital Signature Certificate) of proposed LLP

Limited Liability Partnership (LLP) Registration Process:

Here’s a step by step guide, which will help you to know and understand the process of LLP registration.

Step 1: Obtain Digital Signature Certificate (DSC) for Proposed Designated Partner

Step 2: Obtain Designated Partners Identification Number (DPIN)

Step 3: Obtain Name Approval from MCA

Step 4: Incorporate the LLP Company by Filing Certain Form

Step 5: Filing of LLP Agreement and Partners Details

A limited liability partnership can be incorporated as per the procedure explained below:

- The first step is to acquire the DSC (Digital Signature Certificate) for Designated Partner of LLP/ proposed LLP, whose signature and photo is to be affixed on the e-form along with attested Identity and address proof documents to obtain Class 2 or Class 3 DSC from any authorised certifying authority.

- In second step you have to apply for DPIN/ DIN (Designated Partner Identification Number/ Director Identification Number) for all designated partners of proposed LLP. And for this, you have to apply for DIN through e-Form DIR-3 in MCA portal.

- In third step, before incorporating or registering a limited liability partnership (LLP) company in Bangalore; the applicant/ entrepreneur has to reserve the proposed name of LLP in MCA database and he needs to file the eForm 1 for ascertaining the availability and reservation of unique name of the LLP business.

- In fourth step, once the name is reserved by the ROC, then you can incorporate the LLP company by filing eForm 2 along with necessary documents, which is typically used for incorporating a new limited liability partnership.

E-Form 2 contains all details of LLP proposed to be incorporated, partners’/ designate partners’ details and consent of the partners/ designated partners to act as partner/ designated partner.

After submission of complete documents towards at ROC; then the registrar will scrutiny and verify it, if they satisfied with your relevant compliance provisions of LLP Act, then will register the LLP. And you will be issue a certificate of incorporation in Form 16 within 14 days of filing e-Form 2.

- In fifth step, the applicant has to file LLP Agreement with the Registrar in eForm 3 within 30 days of incorporation of LLP. And the execution of LLP Agreement is mandatory as per Section 23 of LLP Act, 2008.

There are certain documents that have to be provided by both the LLP as well as the partners in order for the company to be registered. An LLP needs to furnish proof of its registered office address and its DSC. The partners have to provide their PAN (permanent account number) cards or any other ID proof, their address proof, their residence proof, and photographs.

In case the partners are foreign nationals or non resident Indians they have to provide their passports. It is very important that these passports are either apostilled or notarized by relevant authorities in the relevant home country of that partner.

In the first step it would cost around INR 1500 to 2500 to get the DSC. The amount in this case depends on the agency that is doing the work. In the second stage the cost for obtaining the DIN is INR 1000 for 2 partners. In the third stage INR 1000 needs to be paid for reserving the name of the LLP. The cost of incorporation, the fourth stage, depends on the capital contribution being made in the company. If it is lower than INR 1 lakh INR 500 has to be paid. However, if the contribution is between INR 1 lakh and 5 lakh it can go up to INR 2000. Once again the costs of filing the LLP agreement depend upon the capital contribution. In case the contribution is lower than INR 1 lakh then you need to pay INR 50 for filing Form 3. There is also the important matter of paying stamp duty. This is decided by the state where the LLP is being formed.

Normally the entire process of forming an LLP starting from the first step till the last one takes almost 15 days. However, the applicants need to furnish all the documents properly for the work to proceed at the proper pace.

Compliances related to limited liability partnership

LLP is required to file the following annually:

- Statements of Accounts and Solvency [in Form-8]: It should be filed within 30 days from the end of 6 months of the financial year.

- Annual Return [in Form-11]: The ‘Annual Return’ is to be filed within 60 days of closing the financial year.

- Audit is compulsory, if turnover exceeds Rs. 40 lakhs or contribution of LLP exceeds Rs. 25 lakhs.